Can a foreigner lease or purchase immovable property in South Africa? And, if this is possible, what are the requirements for such a transaction to be valid? Also, can I lease or sell my property to any foreigner? The answers to these questions are pertinent to landlords and sellers garnering interest of foreign tenants and purchasers.

In South Africa the right of a foreigner to purchase immovable property was restricted in the past by the Aliens Control Act. These restrictions were uplifted in 2003 by the new Immigration Act (“the Act”) which repealed the Aliens Control Act and many of its restrictive provisions and now clearly defines who a legal foreigner is and who is not. In short, a legal foreigner is a person in possession of a valid temporary residence permit or a permanent residence permit approved by the Department of Home Affairs.

The new Act makes provision for various temporary residence permits to be issued to foreigners, including amongst others:

- A visitor’s permit

- A work and entrepreneurial permit

- A retired person permit

In principle a landlord or tenant can legitimately lease or sell immovable property to any person recognised under the Act as a legal foreigner.

Importantly, if a foreigner needs to secure funds to buy immovable property in South Africa, he may borrow only up to a maximum of 50% of the purchase price from a South African financial institution. The balance of the purchase price must be made up of foreign funds, which the foreigner will have to transfer to a South African bank account and the non-resident will need to provide proof of earnings as well as comply with the Financial Intelligence Centre Act.

That said, foreigners working in South Africa with a legal work permit, are not regarded as “non-residents” by the South African Reserve Bank. They are considered to be residents for the duration of the period of their work permit and are therefore not restricted to a loan of only 50% of the purchase price.

It is also important to take note that the Act criminalizes the letting or selling of immovable property to an illegal foreigner by making this transaction equivalent to the aiding and abetting of an illegal foreigner and is such an act classified as a criminal offence in terms of the Act.

In conclusion, a legal foreigner may let or buy immovable property in South Africa, provided that he is the holder of either a legal temporary residence permit or a permanent residence permit approved by the Department of Home Affairs. Ensure that you enquire from your potential tenant or purchaser whether they are legally present in South Africa and obtain the necessary proof from them before entering into any transaction with a foreigner. Also take account of the restrictions on local financing, particularly where the procurement of financing is a condition precedent to the agreement.

Most people are aware that there are certain costs involved in the purchasing or selling of a property. These costs can change depending on the entity that is used to buy the property in. This article will discuss the various cost items that typically affects a property transaction in South Africa.

Costs to the Purchaser

Attorney (Conveyancer’s) Fees

The first cost item to consider when buying a property is the conveyancing (attorney) fees. Although the purchaser pays the Conveyancer’s fee, it is usually the seller who appoints the attorney. This ensures that the conveyancer acts in the Seller’s interest and prevents unnecessary delays in the transfer process.

The conveyancer’s fee is paid for his/her role to change the ownership of immovable property from the Seller to the Buyer in accordance with the Deed of Sale.

Conveyancing Fees are prescribed by the Law Society of South Africa and is calculated on a sliding scale based on the purchase price of the property.

|

Value of property |

Recommended Guideline of Fees for |

|

R80 000 or less |

R3 200,00 |

|

Over R80 000 up to and including R90 000 |

R3 400,00 |

|

Over R90 000 up to and including R100 000 |

R3 650,00 |

|

Over R100 000 up to and including R125 000 |

R3 750,00 |

|

Over R125 000 up to and including R150 000 |

R3 900,00 |

|

Over R150 000 up to and including R175 000 |

R4 200,00 |

|

Over R175 000 up to and including R200 000 |

R4 400,00 |

|

Over R200 000 up to and including R250 000 |

R4 800,00 |

|

Over R250 000 up to and including R300 000 |

R5 500,00 |

|

Over R300 000 up to and including R350 000 |

R5 900,00 |

|

Over R350 000 up to and including R400 000 |

R6 400,00 |

|

Over R400 000 up to and including R450 000 |

R6 900,00 |

|

Over R450 000 up to and including R500 000 |

R7 500,00 |

|

Over R500 000 |

R7 500,00 for the first R500 000 plus R1000,00 |

A question that is often asked, is why the cost of a transaction increases with the property price when to all intents and purposes, the same amount of work is done. The answer to this lies in the risk that the Conveyancer assumes when he/she agrees to the transfer of a property: the greater the selling price, the greater the risks associated with the transaction.

Property Search Fee

The conveyancer has to do a Deed Search to ensure that there are no conditions in the title deed that prevents the proposed nature of the transaction. This is a fairly involved process as in many cases Title Deeds may refer to conditions in prior Title Deeds. For more information on this practice, refer to Meyer de Waal’s article on conditions “behind the pivot deed” published earlier in this blog.

The typical cost to do a Property Search range from R75 to R200 plus VAT.

Postages and Petties

Postages and Petties includes (but is not limited to) telephone costs, postage and courier fees, administration fees and bank charges. As a rule, the Transferring Attorney can recover any direct costs associated with the transfer of a property, but in reality it is often difficult to calculate the exact amount applicable to a specific transaction. Thus an estimate is used. Firms usually charge between R250-00 and R700-00 plus VAT for Postages and Petties.

FICA

With the introduction of the Financial Intelligence Centre Act in 2001, it became compulsory for all persons listed as Accountable Institutions in the Act to establish and verify the identity of any client prior to establishing a business relationship with such client. These include requiring a proof of residential address, the verification of the Identity Documents of the client and an in-person identification of the client. All documents pertaining to such verification must be stored for a period of at least five years.

The cost of a FICA verification varies between R200-00 and R550-00 plus VAT.

Electronic Generation Fees

Not all attorneys charge for Electronic Generation Fees, but nowadays this practice is quite common. This charge is usually disbursed to the purchaser when the Conveyancing Firm makes use of the Transactional Billing option that is offered by many Software Vendors. The Firm pays a fixed amount per set of documents that is generated with the software and this is passed on to the purchaser. The cost of Electronic Generation Fees for Transfers is usually around R150-00 per instruction plus VAT.

Rates Clearance

The conveyancer must obtain a Rates Clearance Certificate from the Local Authority to verify that there are no outstanding Rates and Taxes payable by the Seller. The municipality will not issue a Rates Clearance Certificate before all outstanding monies are paid. The cost of a Rates Clearance Certificate is currently R165-00, depending on the Local Authority.

Provisional Rates and Taxes

The purchaser will have to pay all rates and taxes 4 months in advance before the registration of the property can take place, but can claim a refund from the council for any amount paid, which is attributable to the rates due, following the registration of the Transfer.

Deeds Office Fee

The Deeds Office’s Fee for transferring a property is calculated on a sliding scale based on the purchase price of the property and is published in the Government Gazette from time to time.

|

Value of property |

Deeds Office Fee |

|

R150 000 or less |

R70,00 |

|

Over R150 000 up to and including R300 000 |

R350,00 |

|

Over R300 000 up to and including R500 000 |

R550,00 |

|

Over R500 000 up to and including R1 000 000 |

R650,00 |

|

Over R1 000 000 up to and including R2 000 000 |

R850,00 |

|

Over R3 000 000 up to and including R5 000 000 |

R1 050,00 |

|

Over R5 000 000 |

R1 250,00 |

Transfer Duties

Transfer Duty is a Tax that is levied by the Government on property transactions that depends on the Entity that buys the property.

For Natural Persons the tax is calculated on a sliding scale based on the purchase price of the property:

|

Value of property |

Transfer Duty |

|

From R0 up to and including R500 000 |

R0,00 |

|

Over R500 000 up to and including R1 000 000 |

5% of the amount above R500 000,00 |

|

Over R1 000 000 |

R25 000,00 + 8% of the amount above |

For Legal Persons (Close Corporations, Private and Public Companies and Trusts), transfer duty is calculated at a flat rate of 8% of the purchase price.

Entities that are registered for VAT can claim Transfer Duties paid back from the South African Revenue Service (SARS), but must levy VAT on top of the sale price when they sell the property again.

A Seller registered for VAT can sell a property as a going concern to Purchaser who is also registered for VAT and then a zero vatable transaction can occur. SARS recently published a memorandum on zero VAT transactions. Contact Meyer de Waal on 021 461 0065 for more information.

Home Owners Association Consent and Admin Fee

It is often a condition of the Local Authority that properties in Home Owners Association (HOA) may not be transferred without the consent of the Home Owners Association. This prevents the situation where a property can be transferred to a person who has not bound himself to the rules of the Home Owners Association. The cost levied differs from one HOA to the next, but typically is around R1000-00 plus VAT.

Costs to the Seller

Beetle, Electrical and Gas Conformity Certificates

The seller is obligated to give the buyer an electrical compliance certificate and is liable to pay the cost of any repairs to the electrical installation. Cost: Approximately R375.00

Although it is not compulsory to provide for a beetle-free certificate in a deed of sale, most financial institutions require a certificate before granting a home loan. The seller usually pays the cost associated with such an inspection. Cost: Approximately R375.00

Since 1 October 2009 any property with a gas appliance must be issued with a certificate of conformity. This must be issued by an authorised person registered as such with the Liquefied Petroleum Gas Safety Association of Southern Africa (LPGAS). You can read more on this requirement here. Cost: Approximately R150.00

Capital Gains Tax

Sellers have to pay capital gains tax on a property when it is sold. A capital gain (or loss) is the difference between the base cost of an asset and the net selling price upon the disposal of the asset.

For Natural Persons disposing of their primary residence, the first R1 500 000,00 of the Capital Gain is not taxable where after 25% of the gain is taxed at the individuals marginal tax rate.

For Legal Persons, 50% of the Capital Gain is taxable at the applicable entity’s tax rate.

For an accurate calculation of Capital Gains Tax, click here.

Estate Agent Commission

If a seller employs the services of an estate agent, the amount of commission negotiated will be payable by the seller on the registration of the transfer of the property. Commission usually varies between 3% and 7.5% (excluding VAT) of the selling price of the property.

Bond Cancellation Costs

If a bond is cancelled, the bank may require a three month notice of the seller’s intention to do so. If the seller fails to do this, the bank may charge interest for up to three months.

The fee paid to the attorney of a bank for the cancellation of an existing bond is +/- R 1 600.00.

The residential sector suffered a severe downturn in 2008/09 because:

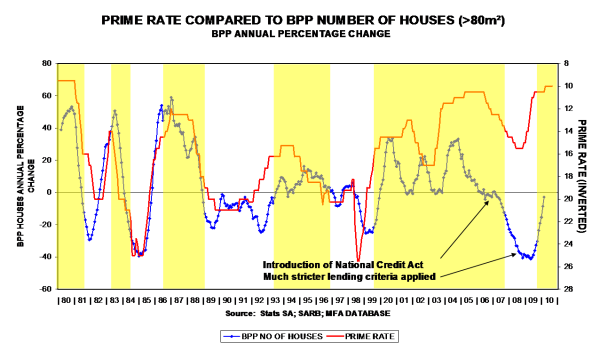

1. Interest rates were raised in mid 2006 to help combat inflation

2. The National Credit Act came in during July 2007, constraining lending

3. The global financial crisis struck in Sept / Oct 2008 and banks tightened their lending criteria quite severely.

In a research report, the J P Morgan investment bank calculated that the tightening of lending criteria had a similar effect on the housing industry as would have been the case if interest rates had risen by 3 percentage points. With interest rates having dropped by 5.5 percentage points since Dec 2008, this implies that the housing industry has effectively only benefited from a 2.5 percentage point drop in interest rates since Dec 2008. The net effect has been to deepen and prolong the homebuilding recession.

The latest June 2010 data were fairly similar to those for May 2010. It seems as if certain segments of the market are forming a trough.

Driving forces: The Cost of Money

Two blows struck the private housing industry in 2007/08 … but it seems that it is responding belatedly to lower interest rates as low current levels are now being compared to low levels a year ago:

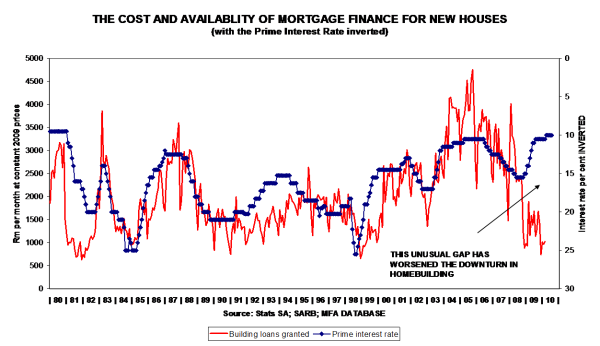

Driving forces: The Availability of Money

This graph shows that – normally - mortgage finance rises when interest rates drop. Mortgage finance drops when interest rates rise. These mortgage finance data lag by three months, but it seems as if it has now hit rock bottom.

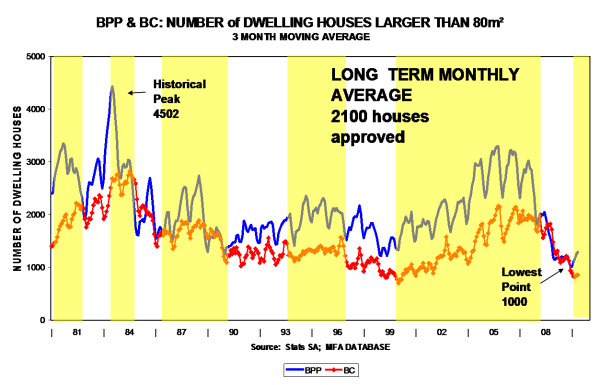

It seems as if BPP has hit rock bottom... currently 1 130

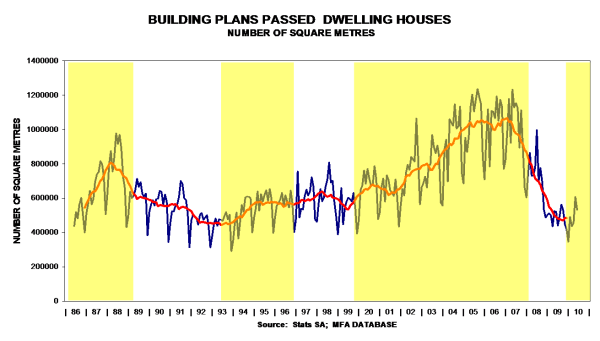

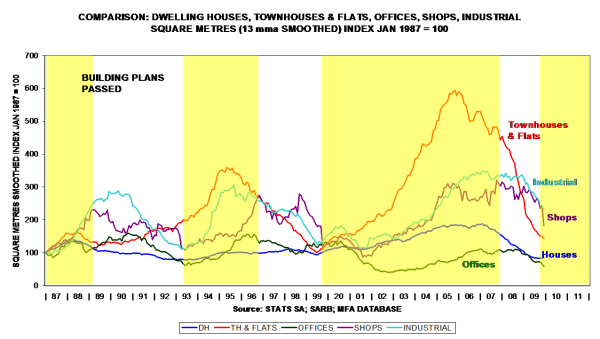

Dwelling houses are forming a through...

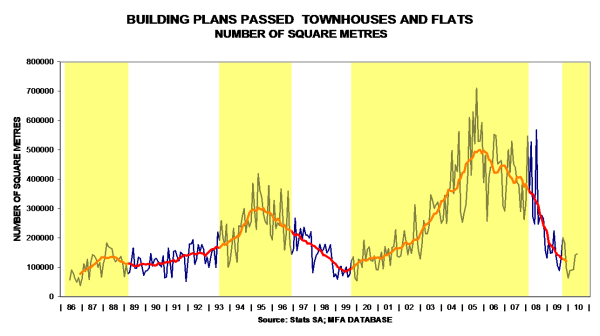

Townhouses and flats also seem to be approaching a trough at a very low level.

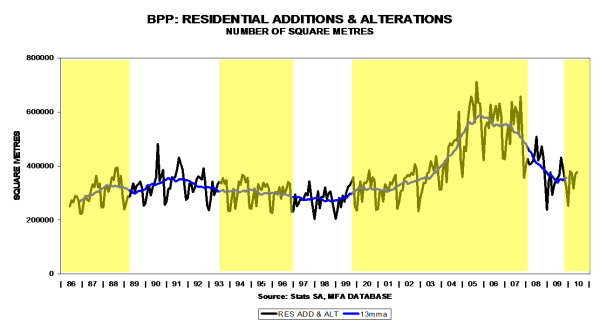

Another through in process?

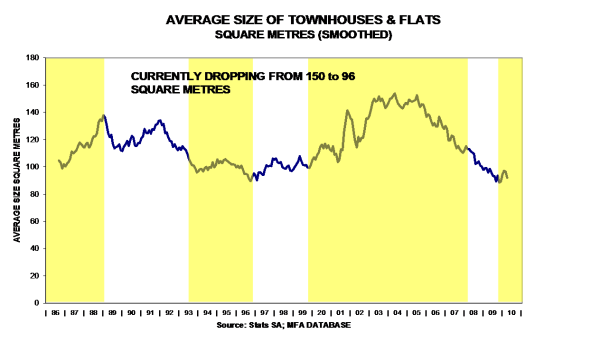

Observe the gradual downtrend in sizes of townhouses and flats

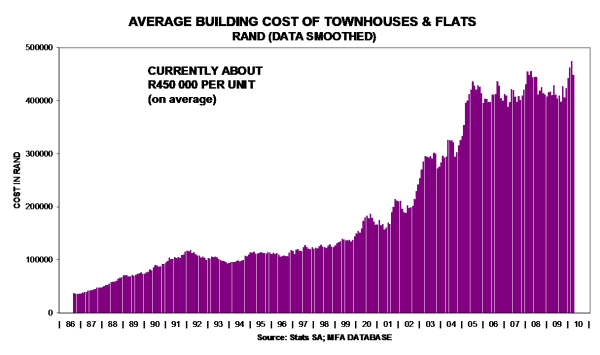

The building cost of townhouses and flats seems to have stabilised between R400 000 and R500 000 per unit, with the potential to rise further from the current R450 000 per unit.

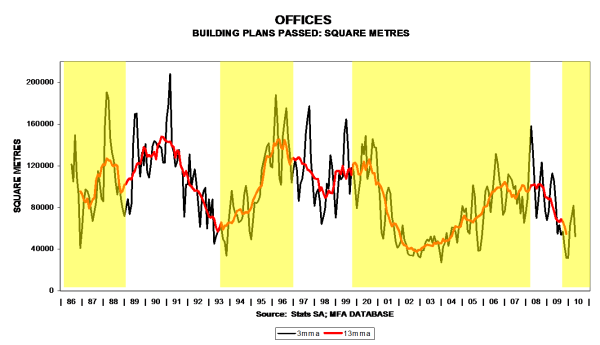

The demand for new office space has dropped to extremely low levels... could this segment also be forming a trough?

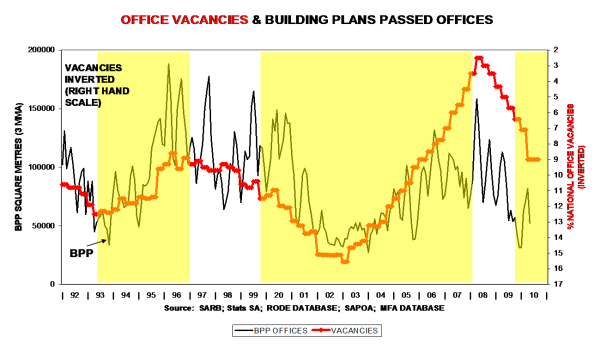

According to SAPOA, office vacancies have stabilised

Definate signs of over-building... still on downtrend:

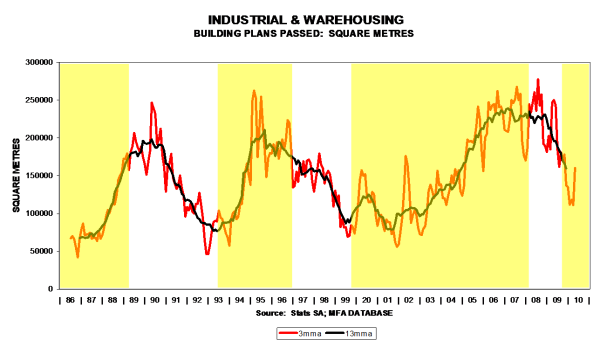

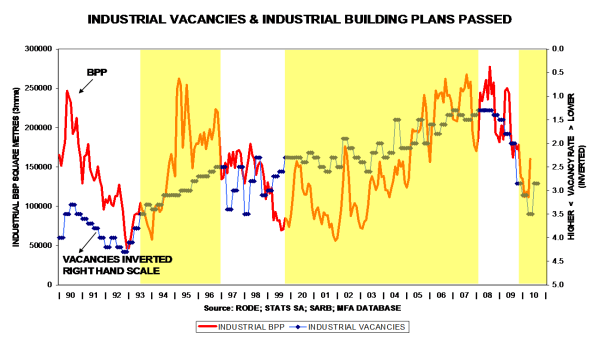

With manufacturing production improving by almost 9% year-on-year in June 2010, could this be the trough of the Industrial cycle?

According to Rode & Associates, industrial vacancies seem to have stabilised

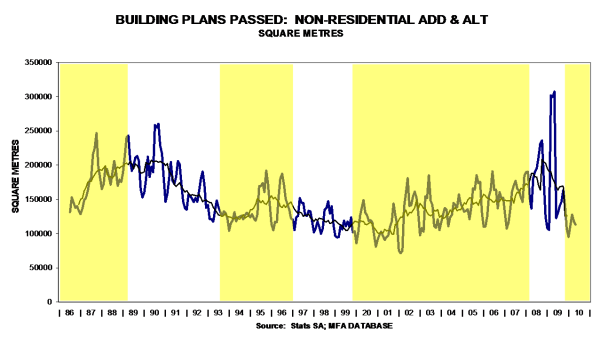

Little sign of improvement:

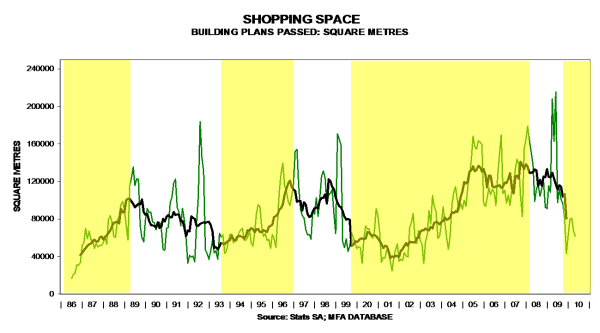

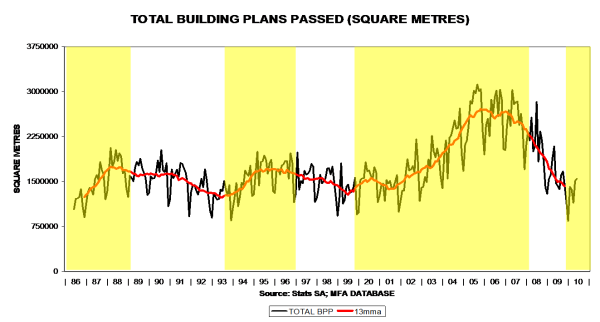

Could we be approaching the lower turning point in terms of square metres? Initial signs of a trough are evident:

Each segment needs to be compared to itself to identify long term cyclical trends: all are still downward, with townhouses & flats having risen and fallen most since 2009. Are square metres of houses bottoming out?

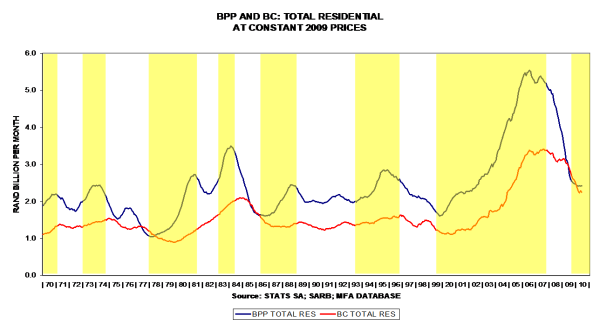

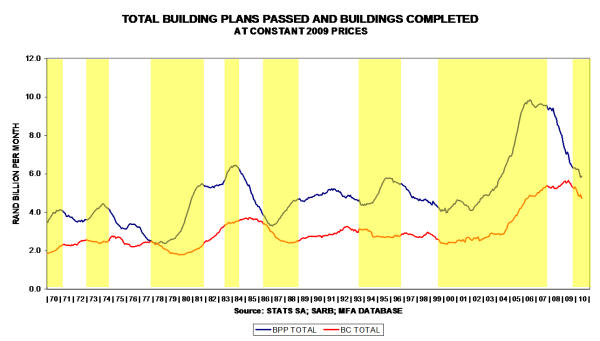

Total residential plans passed and buildings completed (in deflated value terms) are still performing poorly, but initial signs of a bottoming out are starting to appear.

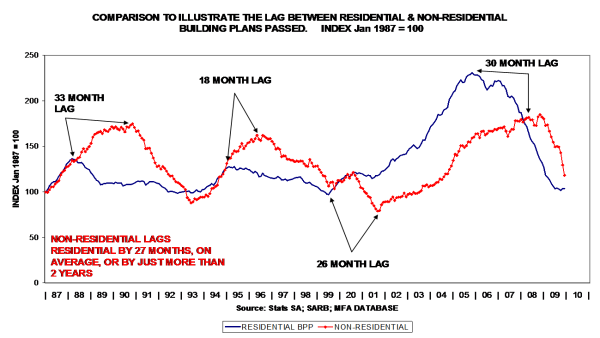

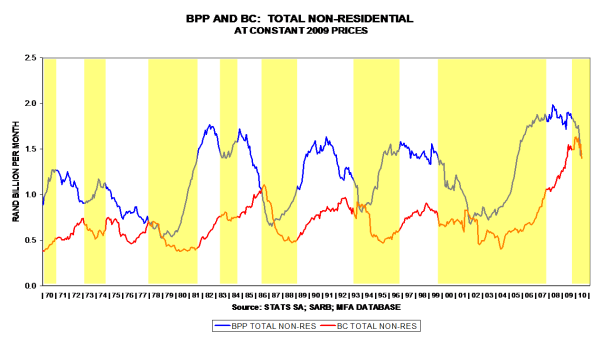

Non-residential BPP is expected to drop further in 2010/2011 and a revival can only be expected late in 2012:

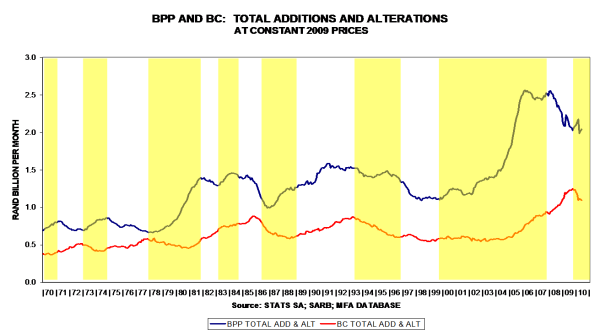

BPP seems volatile, whilst BC is a lagging indicator that could drop further:

Both indicators are still performing poorly, but a drop in the early part of an economic growth phase seems part of the normal pattern.

The lags evident in these indicators suggest that the residential sector could bottom out during 2010, but that the non-residential could still drop further.