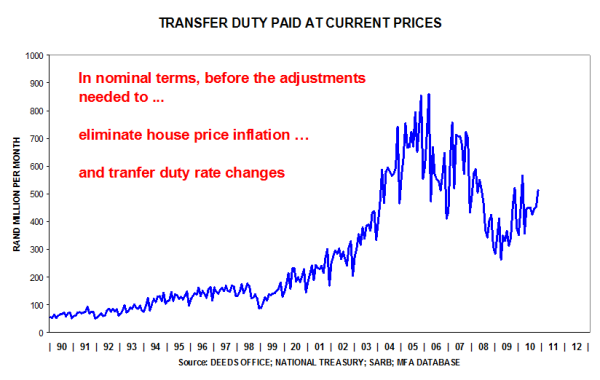

The level, in nominal terms, is recovering.

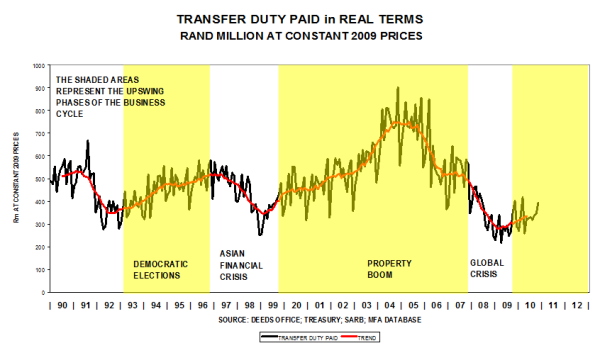

After eliminating inflation, the real level shows a steady improvement.

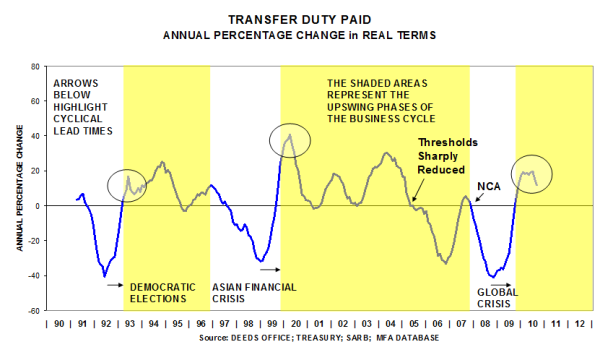

The annual percentage movement is conforming to pattern … first, rising rapidly, then moderating during the early part of the growth phase (refer circles).

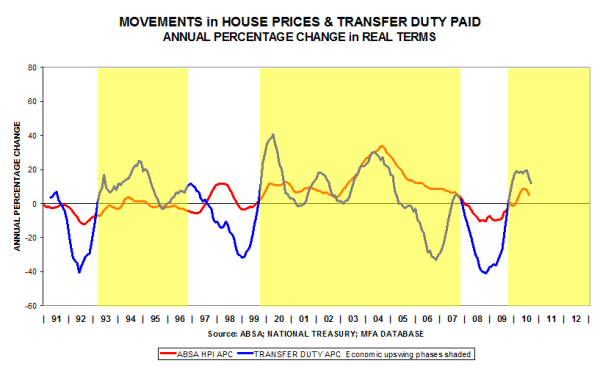

House price movements feed into the values of property transactions, on which transfer duties are based, hence the correspondence in cyclical movements. The activity series is more volatile than the price series because of significant changes in the underlying numbers of property transactions.